In a 1997 article entitled “More (or Less) on Globalization,” Paul Sweezy referred to “the three most important underlying trends in the recent history of capitalism, the period beginning with the recession of 1974-75: (1) the slowing down of the overall rate of growth; (2) the worldwide proliferation of monopolistic (or oligopolistic) multinational corporations; and (3) what may be called the financialization of the capital accumulation process.” (Globalization, he argued was not a recent trend but a process that characterized the entire history of capitalism.)1 The first and third of these three trends—economic stagnation in the rich economies and the financialization of accumulation—have been the subjects of widespread discussion since the onset of severe financial crisis in 2007-09. Yet the second underlying trend, which might be called the “internationalization of monopoly capital,” has received much less attention. Indeed, the dominant, neoliberal discourse—one that has also penetrated the left—assumes that the tendency toward monopoly has been vanquished. In this narrative, the oligopolistic structure of early post-Second World War capitalism in the United States and elsewhere was broken down and replaced by a new era of intense global competition.

We do not intend to argue, in what follows, that those perceptions of growing global competition were all wrong. Rather, we suggest that renewed international competition evident since the 1970s was much more limited in range than often supposed. It has since given way to a new phase of global monopoly-finance capital in which world production is increasingly dominated by a relatively few multinational corporations able to exercise considerable monopoly power. In short, we are confronted by a system of international oligopoly. We present the broad contours of our argument with empirical evidence and explanation. Our treatment of these issues will no doubt raise as many questions as it will answer. Nevertheless, our objective is to demonstrate that addressing the internationalization of monopoly capital is a necessary prerequisite to understanding present global economic trends, including the period of slow growth and financialization in the mature economies.

The general outlines of what we have to say will not, of course, be a revelation to all of our readers. Evidence of the internationalization of monopoly capital has been mounting for decades. As Richard Barnet and Ronald Müller wrote in 1974 in their book, Global Reach: The Power of the Multinational Corporations: “The rise of the global corporation represents the globalization of oligopoly capitalism….The new corporate structure is the culmination of a process of concentration and internationalization that has put the economy under the substantial control of a few hundred business enterprises which do not compete with one another according to the traditional rules of the classic market.”2

As in all cases of oligopoly, where a few firms dominate particular industries or spheres of production, what is evident is not competition in the classic sense. Rather we are confronted with a dialectic of rivalry and collusion.3 In particular, “price competition”—or “price warfare,” as it is often called in business—is viewed as too dangerous, and generally avoided by the giant corporations. Instead, competition between firms largely takes other forms: the search for low-cost position, which remains the bottom line for business; competition for resources and markets; and product differentiation.

The typical or representative firm today is a monopolistic multinational corporation—a firm that operates in numerous countries, but is headquartered in one. In recent years, there has been a growth of multinational corporations in the periphery of the capitalist economy, but in the main such global firms are predominantly headquartered in the rich nations of the center (the more so the larger the firm). As the United Nations Conference on Trade and Development (UNCTAD) stated in its 2010 World Investment Report, “The composition of the world’s top 100 TNCs [transnational corporations] confirms that the triad countries [the United States, the European Union, and Japan] remain dominant,” although “their share has been slowly decreasing.”4

Mark Casson, a leading mainstream analyst of the global corporation, observed in 1985: “From a broad long-run perspective, the postwar MNE [multinational enterprise] may be regarded simply as the latest and most sophisticated manifestation of a tendency towards the international concentration of capital. This view emerges most clearly from the work of Lenin [in Imperialism, the Highest Stage of Capitalism].”5

Today this tendency is manifested most concretely in the growth of international oligopolies. For Louis Galambos, a business historian at Johns Hopkins University, “global oligopolies are as inevitable as the sunrise.”6 Indeed, as the Wall Street Journal put it in 1999:

In industry after industry the march toward consolidation has seemed inexorable….The world automobile industry is coalescing into six or eight companies. Two U.S. car makers, two Japanese and a few European firms are among the likely survivors.

The world’s top semiconductor makers number barely a dozen. Four companies essentially supply all of the worlds recorded music. Ten companies dominate the world’s pharmaceutical industry, and that number is expected to decline through mergers as even these giants fear they are too small to compete across the globe.

In the global soft drink business, just three companies matter, and the smallest, Cadbury Schweppes PLC, in January sold part of its international business to Coca-Cola Co., the leader. Just two names run the world market for commercial aviation: Boeing Co. and Airbus Industrie.7

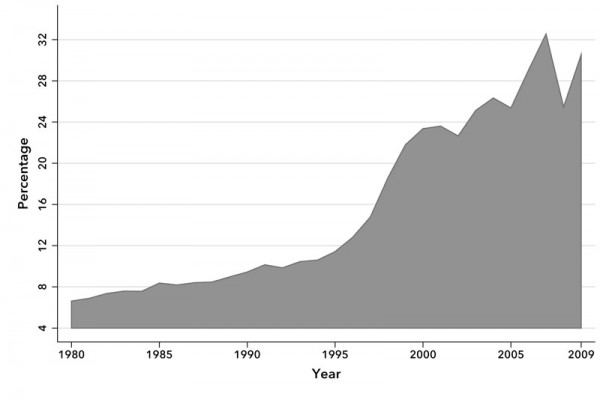

The same tendency is evident across the board: in areas such as telecommunications, software, tires, etc. This is reflected in record annual levels of global mergers and acquisitions up through 2007 (reaching an all-time high of $4.38 trillion), and in vast increases in foreign direct investment (FDI), which is rising much faster than world income. Thus FDI inward stock grew from 7 percent of world GDP in 1980 to around 30 percent in 2009, with the pace accelerating in the late 1990s. (See Chart 1, below.) Even these figures are conservative in demonstrating the growing power of multinationals since they do not capture the various forms of collusion, such as strategic alliances and technological agreements that extend the global reach of such firms. Nor is there any accounting of the massive subcontracting done by multinational corporations, extending their tentacles into all areas of the global economy. In these and other ways, the rapid expansion of multinationals is creating a more concentrated world economic system, with the revenue of the top five hundred global corporations now in the range of 35-40 percent of world income.8

Chart 1. Foreign Direct Investment (Inward Stock) as a Percentage of World Income, 1980-2009

Note: FDI stock is the value of the share of capital and reserves (including retained profits) of affiliates attributable to their parent enterprises, plus the net indebtedness of affiliates to parent enterprises.

Source: UNCTADStat, United Nations Conference on Trade and Development (UNCTAD), http://unctadstat.unctad.org (Geneva: Switzerland, 2011). GDP and FDI are in current U.S. dollars.

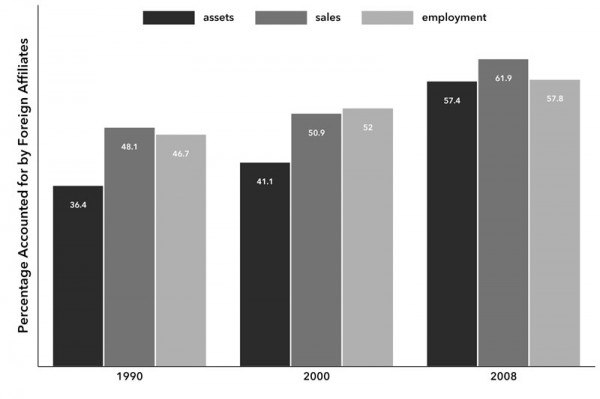

As giant corporations operate more and more, not in one but in twenty or even fifty or more countries, production has shifted to a global plane. This is shown in Chart 2 by the rapid growth in the proportion of assets, sales, and employment accounted for by the foreign affiliates of the top one hundred nonfinancial (nonbank) multinational corporations—ranked according to the assets of their foreign affiliates. As recently as 1990, the foreign affiliates of the world’s top one hundred nonfinancial multinationals accounted for only a little over a third of the total assets and less than half of the sales and employment of these firms, with production still largely based in their parent companies headquartered in their home countries. By 2008, however, these top one hundred global corporations had shifted their production more decisively to their foreign affiliates, which now account for close to 60 percent of their total assets and employment, and more than 60 percent of their total sales.

Chart 2. Share of Foreign Affiliates in the Assets, Sales, and Employment of the World’s Top 100 Nonbank Multinational Corporations

Notes: The list is made up of nonfinancial multinational corporations (MNC) ranked by foreign assets. “Foreign affiliates” are defined by at least 10 percent ownership by the parent. If no foreign assets, sales or employment were reported, the non-reporting MNC was dropped. This primarily affected assets in 1990, reducing the total to 78 MNCs.9

Source: UNCTAD, World Investment Report (New York: UNCTAD, 1993, 2002, and 2010).

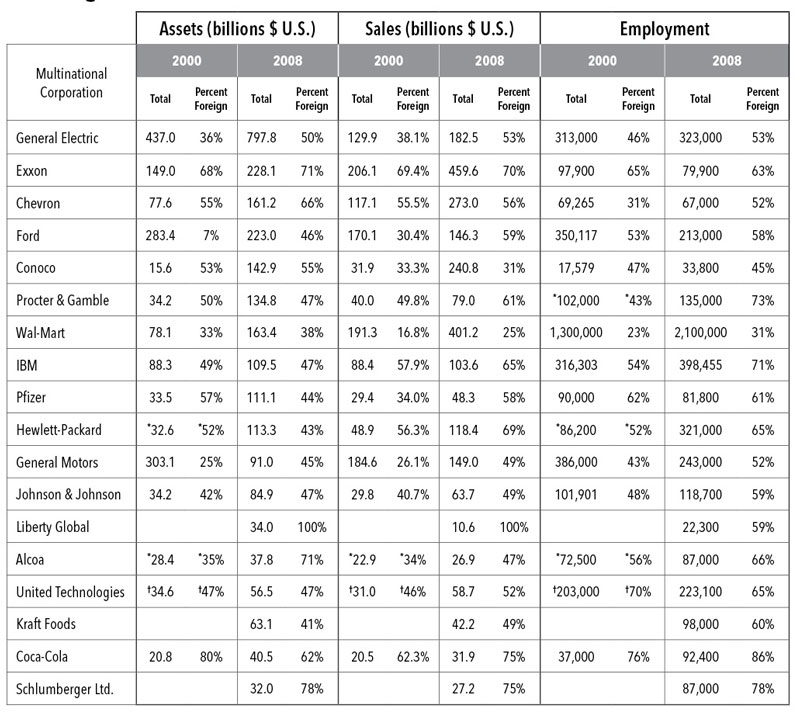

U.S. corporate giants have, in recent decades, made the transition to production on a truly global scale. Table 1 presents data on the total assets, sales, and employment of the eighteen U.S. multinational corporations in the top one hundred multinationals worldwide. (Because the U.S. domestic market is so large and because the ranking of the top one hundred multinational corporations is based solely on foreign affiliate assets, there are only eighteen U.S. corporations among the top one hundred multinationals worldwide when ranked in this way.) These eighteen corporations represent a substantial share of the assets, sales, and employment of all U.S. nonfinancial multinational corporations: holding close to 16 percent of the total assets, raking in 28 percent of the sales, and accounting for nearly 23 percent of employment.10 About half or more of the total assets and production of all eighteen of these U.S. firms is attributable to their foreign affiliates, indicating that these corporations are deeply engaged in global oligopolistic competition/rivalry.

As Table 1 shows, a majority of these U.S. corporations in the top one hundred multinationals experienced, between 2000 and 2008, substantial (and, in some cases, huge) increases in the share of assets, sales, and employment of their foreign affiliates. To take a few examples, the share of foreign assets, sales, and employment represented by General Electric’s (GE’s) foreign affiliates rose from 36 percent, 38 percent, and 46 percent, respectively, in 2000, to 50 percent, 53 percent, and 53 percent in 2008—making GE primarily a global, as opposed to U.S., producer. For Ford, the share of foreign affiliate assets/sales/employment rose even more dramatically, with foreign affiliate assets climbing from 7 percent to 46 percent of Ford’s total assets between 2000 and 2008, and the sales and employment of its foreign affiliates rising from 30 percent and 53 percent to 59 percent and 58 percent. In 2008, therefore, the Ford parent company accounted for only a little over 40 percent of both sales and employment. A full 86 percent of Coca-Cola’s total workforce in 2008 was employed by its foreign affiliates.

Table 1. Foreign Assets, Sales, and Employment of Top 18 U.S. Nonfinancial Multinational Corporations (Ranked by Foreign Affiliate Assets), 2000 and 2008

Source: UNCTAD, World Investment Report (New York: UNCTAD, various years).

* Figures are for 2001; † Figures are for 2003.

These firms represent an extreme in terms of the internationalization of U.S. multinational corporations. For U.S. multinationals as a whole (which includes smaller firms and financial as well as nonfinancial corporations), U.S. parents in 2008 still accounted for more than two thirds, and foreign affiliates less than one third, of their combined valued added, capital expenditures, and employment. Nevertheless, the share of the parental companies in value added in 2008 had fallen by about 10 percentage points over the two preceding decades, suggesting a strong trend toward greater internationalization for U.S. multinationals as a whole.11

The concentrated economic power of international monopoly capital is also evident in the various kinds of strategic alliances that global corporations construct. This led Joseph Quinlan, senior economist of Morgan Stanley Dean Witter, to coin the term “Alliance Capitalism” in 2001. “Foreign direct investment and trade,” Quinlan wrote, “are the primary, although not the only, means of global engagement.” Other means include “subcontracting agreements, management contracts, turnkey deals, franchising, licensing, and product sharing. Of particular importance…has been the rise of strategic alliances and partnerships, which have become nearly as prominent—if not more so in some industries—over the past decade as global mergers and acquisitions.” In the 1980s and ’90s, Ford, for example, formed dozens of global technology agreements with the suppliers of inputs for its components, its manufacturing technology providers, its equipment suppliers, and other auto manufacturers.

The world’s major airlines have “coalesced into a handful of mega-alliances.” For example, just one of these, the Star Alliance, includes United Airlines, Continental Airlines, and US Airways (United States); Air Canada (Canada); BMI (United Kingdom); Lufthansa (Germany); Brussels Airlines (Belgium); Swiss (Switzerland); Austrian (Austria); Spanair (Spain); Tap Portugal (Portugal); Lot Polish Airlines (Poland); Croatia Airlines (Croatia); Adria (Slovenia); SAS (Scandinavia); Blue1 (Finland); Aegean (Greece) Turkish Airlines (Turkey); Egyptair (Egypt); Thai (Thailand); Singapore Airlines (Singapore); Tam (Brazil); Air New Zealand (New Zealand); South African Airways (South Africa); ANA (Japan); Asiana Airlines (Korea); and Air China (China). “United and its counterparts” in the Star Alliance, Quinlan explained, “have achieved greater economies of scale by alliance building—pooling assets, whether they are planes, code-sharing capabilities, frequent-flyer programs, catering services, training, maintenance, or even aircraft buying programs.” The result is, in effect, a global fleet of aircraft operating under the leadership of a single dominant carrier, in this case United. Mega-alliances of this sort serve to enhance international oligopoly.

“Even Microsoft, arguably one of the most powerful companies in the world,” Quinlan continues, “has had to enter into multiple strategic alliances (with Ericsson, British Telecommunications, Telmex, and others)….Like many other companies, Microsoft hopes to position itself in the center of a global constellation, thereby leveraging global resources.”12

A large part of world trade is now dominated by the outsourcing of multinational corporations. One crude estimate is that at least 40 percent of world trade is linked to outsourcing.13 Of that, subcontracting has assumed a large role. According to the United Nations, subcontracting agreements of multinational corporations now number in the hundreds of thousands.14 Global corporations and their affiliates frequently rely on sweatshops run by subcontractors to obtain lower unit labor costs. A well-known example is Nike, which, as a “hollow corporation,” outsources all of its production to subcontractors in Asia in such countries as South Korea, China, Indonesia, Thailand, and Vietnam. In 1996 a single Nike shoe contained 52 different components produced by subcontractors in five different countries.

In Indonesia in the 1990s, where Nike manufactured seventy million pairs of shoes in 1996 alone, young girls were being paid as little as fifteen cents an hour for an eleven-hour day. Indonesian workers as a whole made an average of around $2.00 per day, well below a living wage. The Multinational Monitor calculated in the late 1990s that the entire labor cost for the production of a pair of $149.50 basketball shoes (if produced entirely in Vietnam), would be $1.50—1 percent of the final retail price in the United States.15

By using subcontractors, which removes its direct involvement in production, Nike has been able to take advantage of extreme forms of labor coercion, while defusing much of the criticism associated with such gross exploitation. For example, in 1997, a labor investigator visiting a factory in Ho Chi Minh City operated by a Nike subcontractor firm from Taiwan, saw a manager ordering fifty-six workers to run around the factory grounds until fifteen collapsed from the heat. In early 1998, an ESPN film crew was in Ho Chi Minh City and witnessed a manager at one of Nike’s Korean subcontractor firms slapping a worker for not spreading glue properly, and another hurling a shoe at a worker. In response to criticisms directed at similar abuses, Nike billionaire Phil Knight responded by declaring that these were subcontractors, not companies that Nike owned or managed.16 Although Nike subsequently voluntarily adopted new labor standards in its outsourcing, it continues to rely on subcontracting through sweatshops, where exploitation of labor is at its highest.17

Nike’s oligopolistic rivals, like Reebok, are compelled to use the same forms of outsourcing—and coercion—through sweatshop subcontractors in order to achieve similar high profit margins derived from low unit labor costs, if they are to stay in business. A recent report by the National Labor Committee indicates that in 2010, women workers employed in El Salvador by the Singapore-based subcontractor Ocean Sky to make National Football League (NFL) T-shirts, commissioned by Reebok, were “paid just eight cents for every $25 NFL T-shirt” they produced—meaning their wage amounted to “three-tenths of one percent of the NFL’s retail price.”18

As “more and more firms externalize non-strategic activities,” relying less exclusively on FDI or direct ownership, French political economist Beatrice Appay argues, they continue to maintain a “high level of control through subcontracting.” Yet this tendency is not captured in the standard definition of multinational corporations based on FDI, which excludes all indirect forms of control and therefore masks the true extent of MNC power. Firms like Nike and Apple (which subcontracts its production to China) are rightly seen as monopolistic multinational corporations—capturing extremely high profit margins through their international operations and exerting strategic control over their supply lines—regardless of their relative lack of actual FDI.

Further, many of those firms with high levels of FDI, like GE, are themselves major international subcontractors. Thus, GE relies heavily on the Singapore-based subcontractor Flextronics and China’s Kelon to provide it with electronic parts. A characteristic of the world of subcontracting is that the same subcontractor may work simultaneously for several different giant corporations, which collude rather than compete in this respect. Thus Flextronics, one of the world’s largest subcontractors in electronics manufacturing, supplies parts not only to GE, but also to Honeywell, Compaq, Pratt and Whitney, Nortel, and others. 19

Blockages to Understanding International Oligopoly

Oddly, so focused have economic and political discussions been on ever increasing international competition, that the actual growth of a more monopolistic world economy has been largely overlooked, even by those on the left. What has made the shift toward a world economy dominated by international oligopolistic rivalry/collusion so difficult to understand has to do primarily with five common blockages in our thinking: (1) the tendency to think of economic categories exclusively in national, rather than international, terms; (2) a fetishism of “the market,” excluding the analysis of corporate power; (3) what we have called “the ambiguity of competition”; (4) the notion that financialization and new communication technologies have engendered unstoppable global competition; and (5) a common category mistake at the international level that confuses competition between capitals with competition between workers.

In discussing international competition from the standpoint of any given nation-state—particularly from the standpoint of the United States, which long enjoyed unrivaled economic hegemony in the world economy—it is assumed that international competition is simply going up when it appears to impinge on industrial concentration and the degree of monopoly in that country. The most famous example of this is the weakening of the tight oligopoly of U.S. automakers in Detroit as a result of the invasion of foreign, particularly Japanese, firms. What is less frequently recognized, however, is that this weakening was part of the shift to concentration and centralization of production on an international plane. “As U.S. companies fell by the wayside in several industries” in the competition of the 1970s and ’80s, Galambos observed in 1994 in “The Triumph of Oligopoly,” “new global oligopolies began to emerge….Whatever the outcome of this competition, the form that seems most likely to emerge is that of global oligopoly.”20 Indeed, five multinational firms, two of which (GM and Ford) are U.S., now account for almost half of the world’s auto production, while ten firms control 70 percent of global production. Oligopoly in auto production thus now exists on a world scale, with all of the major firms operating on a global plane.21

A second blockage to our thinking is the common designation of economic relations in terms of abstract economic forces and flows—the market—while ignoring the role of giant corporations in shaping the economic terrain. The notion of the free market in today’s economic theory has little real meaning other than the fact that it explicitly excludes the state, and implicitly excludes all considerations of institutional power within the economy: namely, the role played by giant corporations.22

Third, a serious blockage to our thinking is to be found in the confusions surrounding the concept of competition—as this is commonly understood in economics, on the one hand, and in more colloquial (including business) terms, on the other. In economic theory, competition in the fullest sense rests on the existence of large numbers of small firms, none of which has any power to control the market. Other competitors, though they exist, are essentially anonymous. Hence, direct rivalry between firms is minimal. Viewed from this standpoint, as numerous economists, including Milton Friedman, have pointed out, the intense rivalry that often characterizes oligopolistic markets—with which competition is almost exclusively associated today—is closer to monopoly in economic terms than to competition.23 Hence, “the ambiguity of competition.”24

Indeed, the dialectical counterpart of such oligopolistic rivalry (often mistaken for simple competition) is a tendency toward collusion, particularly where threat of destructive price competition between the giants is concerned. The logic of this process was well described by Paul Baran and Paul Sweezy in Monopoly Capital:

The typical giant corporation…is one of several corporations producing commodities which are more or less adequate substitutes for each other. When one of them varies its price, the effect will immediately be felt by the others. If firm A lowers its price, some new demand may be tapped, but the main effect will be to attract customers away from firms B, C, and D. The latter, not willing to give up their business to A, will retaliate by lowering their prices, perhaps even undercutting A. While A’s original move was made in the expectation of increasing its profit, the net result may be to leave all the firms in a worse position….

Unstable market situations of this sort were very common in the earlier phases of monopoly capitalism, and still occur from time to time, but they are not typical of present-day monopoly capitalism. And clearly they are anathema to the big corporations with their penchant for looking ahead, planning carefully, and betting only on the sure thing. To avoid such situations therefore becomes the first concern of corporate policy, the sine qua non of orderly and profitable business operations.

The objective is achieved by the simple expedient of banning price cutting as a legitimate weapon of economic warfare. Naturally this has not happened all at once or as a conscious decision. Like other powerful taboos, that against price cutting has grown up gradually out of long and often bitter experience, and it derives its strength from the fact that it serves the interests of powerful forces in society. As long as it is accepted and observed, the dangerous uncertainties are removed from the rationalized pursuit of maximum profits.25

According to this analysis, the major firms in a mature industry are not pure rivals but rather oligopolistic competitors that engage in what Joseph Schumpeter called “corespective pricing.”26 No corespector can lower prices, without expecting retaliation from its rivals. Given the destructive nature of such price warfare, the tendency, as Baran and Sweezy suggested, is toward collusion in the realm of price. Price cutting in such concentrated industries is rare, while price increases by firms generally occur in tandem, most commonly under the price leadership of the largest corporation in the industry.

Our argument is that with concentration and centralization on a world scale and the proliferation of multinational corporations, which now increasingly govern world production, the nature of competition has changed—not only at the national but now at the international level as well. Thus, for economists Edward Graham and Paul Krugman, writing in 1995 in Foreign Direct Investment in the United States, the direction of FDI is, to a substantial extent, a product of “oligopolistic rivalry.”27 Today’s now-dominant firms strive for ever greater monopolistic advantages derived from strategic control of the various elements of production and distribution, while resisting genuine price competition, not only at the national but also the international level.

A fourth common blockage in our thinking is the notion that the growth of finance and the new digital communication technologies has greatly increased market competition at the expense of the tendency toward monopoly/oligopoly. But financialization and digitalization are, in fact, integrally related to the development and maturation of the giant corporation. Finance made the modern corporation possible and accelerated the centralization of capital, particularly through mergers and acquisitions. In today’s era of global monopoly-finance capital, financial capital, which once promoted national consolidations of economic power, is now extending its role in corporate consolidation to the global level. Moreover, financial corporations themselves have been increasingly subject to concentration and centralization on a world scale, becoming part of the transnational migration of capital. Information technology, which was once thought to be the great leveler, is itself undergoing global monopolization, while augmenting monopolization trends generally.28

A final blockage to comprehending the tendency toward global monopolization consists of a simple category mistake, wherein competition between firms—what economists primarily have in mind when they discuss competition—is confused with competition between workers.29 Corporations seek, by means of divide-and-rule strategies, to gain advantages over different local, regional, and national labor markets, benefitting from the reality that, while capital is globally mobile, labor—due to a combination of cultural, political, economic, and geographical reasons—for the most part, is not. Consequently, workers increasingly feel the crunch of worldwide job and wage competition, and giant capital enjoys widening profit margins as the world races to the bottom in wages and working conditions. In neither mainstream nor radical economics is such competition between workers considered to be economic competition, which has to do primarily with the firm and price-determination.

In Marxian theory, competition between workers, as distinct from competition between capitals (or competition proper), is related to the class struggle. It is a form of conflict engendered between workers by capital through the creation of an industrial reserve army of the unemployed. This divide-and-rule strategy integrates disparate labor surpluses, ensuring a constant and growing supply of recruits to the global reserve army, which is made less recalcitrant by insecure employment and the continual threat of unemployment.30 For French sociologist Pierre Bourdieu, “the structural violence of unemployment,” including the “fear provoked by the threat of losing employment,” is the “condition of the ‘harmonious’ functioning of the individualist micro-economic model.” Or, as legendary U.S. capitalist Samuel Insull put it nearly a century ago, with the candor of a pre-public relations era, “My experience is that the greatest aid to efficiency of labor is a long line of men waiting at the gate.”31

Today we often hear—in the ideology of national competition so often used to channel class dissatisfaction—that U.S. workers are facing increased competition for jobs with Mexican workers, Chinese workers, Indian workers, etc. In our view, this is not a reflection of increased competition—certainly not in the sense that this term is used in economics—but of the growth of monopolistic multinational corporations, which, through their much larger number of foreign affiliates, their still larger numbers of subcontractors, and their corrupt domination of national governments and policymaking, are able to employ a strategy of divide and rule with respect to the workers of the world. Competition between workers is aggravated as the internationalization of monopoly capital grows more certain: they are two sides of the same coin. The result is a worldwide heightening of the rate of exploitation (and of the degree of monopoly). Tariffs and capital controls were battered down through GATT and WTO under the leadership of capital from the center because imperial corporations believed they were strong enough to outcompete firms in the periphery. The resulting free movement of capital has contributed to real wage stagnation or actual wage decrease for the relatively privileged workers in the countries of capitalism’s core, while worsening the conditions of the vast majority of the much poorer workers in the periphery

The Law of Increasing Firm Size and the Rise of the Multinational Corporation

From its inception, capitalism has been a system driven above all by the accumulation of capital, based on control over and exploitation of the labor force—with competition between capitals representing the mechanism that makes rapid accumulation into a law imposed on each and every individual capital. As Marx wrote: “The development of capitalist production makes it necessary constantly to increase the amount of capital laid out in a given industrial undertaking, and competition subordinates every individual capitalist to the immanent laws of capitalist production, as external and coercive laws. It compels him to keep extending his capital, so as to preserve it, and he can only extend it by means of progressive accumulation.”32 Accumulation naturally goes hand in hand with the concentration and centralization of capital and the monopolization of the main means of production in a relatively few hands.

Looking back over the history of capitalism, we can see evidence of what the most famous analyst of the multinational corporation, radical economist Stephen Hymer, called “The Law of Increasing Firm Size.” In his words: “Since the beginning of the Industrial Revolution, there has been a tendency for the representative firm to increase in size from the workshop to the factory to the national corporation to the multi-divisional corporation and now to the multinational corporation.”33 In early mercantilist capitalism, one of the principal ways of carrying out production was the putting-out system, whereby a capitalist provided workers with the means of production and the raw materials to produce goods in their homes, and then went around and collected the products of the workers’ labor, paying them a minimal sum. This system, however, had the disadvantage of not allowing the capitalist to supervise the labor process of the worker directly.34 As a result, the organization of production moved to the workshop—or to what Marx called the phase of “cooperation”—whereby the workers were brought together and subjected to a single owner-manager. This set the stage for a more developed division of labor (exemplified by Adam Smith’s famous discussion of pin manufacture). This internalization of previous market relations was the beginning of the factory system, which preceded the widespread introduction of machinery.35

In Marx’s terms, the division of labor under capitalism could be seen as evolving broadly from the period of “manufacture,” i.e., the creation of goods simply through human labor applied to raw materials, to the period of “modern industry” (or machinofacture), marked by the subordination of labor to machinery, and corresponding to the Industrial Revolution itself. The essence of this process throughout was the evolution of capital’s control of labor power in the factory, which then generated a greater surplus product or profit.

The initial development of the division of labor in the workshop and under factory conditions was associated with the small-family-owned and -managed firm.36 However, the concentration and centralization of capital meant that the small-family firm was soon replaced by the large industrial corporation. Thus, the representative individual capital grew in size. This was due not only to the straightforward amassing of wealth (or concentration proper), but also to centralization: the fact that big capitals generally beat (and absorb) smaller ones. Centralization was greatly enhanced by finance, which facilitated gargantuan mergers and acquisitions. In 1901, for example, 165 steel firms were combined in a single year to create U.S. Steel, the first billion-dollar corporation, with J.P. Morgan’s financial empire providing the necessary credit.37

Large firms enjoyed enormous advantages over small firms: not only economies of scale of all kinds, but also specifically monopolistic advantages resulting from barriers to entry, and the capacity, therefore, to acquire monopoly rents. Moreover, once a corporation became big enough to impact the economy generally, it exercised its power in the political sphere, enabling it to draw more fully on state subsidies and support—as the whole history of monopoly capitalism has demonstrated.38 Consequently, by the twentieth century, the typical business enterprise was no longer the small-family firm celebrated in Alfred Marshall’s Principles of Economics but a large monopolistic corporation.39

Managerial control of labor in the competitive stage of capitalism was fairly simple or crude.40 But as firms increased in size along with the expansion of the market, a more complex and systematic division of labor became possible under the new regime of monopoly capitalism. Frederick Winslow Taylor’s well-known introduction of scientific management at the beginning of the twentieth century, in which knowledge and control of the labor process was increasingly removed from the laborer and concentrated in management, along with the enormous intensification of actual labor that this brought about, represented the historical emergence of what Marx had called, the “real” as opposed to the “formal subsumption” of labor under capital.41

It was this, along with the banning of price competition among oligopolies, and a host of other factors, that led to the triumph of monopoly capital. It was in this era that the modern multidivisional corporation (first developed by railroad capital), oligopoly, horizontal integration, vertical integration, conglomeration, the market for industrial securities, and the multinational corporation all arose. The “three cardinal attributes of business enterprise—investment expansion, concentration of corporate power, and the growth of the world market—are,” Harry Magdoff observed in 1978, “eventually uniquely fulfilled in the multinational corporation.” However, the rise of the multinational, he added, could not “take shape until the concentration of capital” had reached “the stage conveniently called monopoly capitalism (as distinguished from competitive capitalism), in which competition among only a few giant corporations is the typical pattern in each of the leading industries.”42

Since the multinational corporation in this sense is a product of the inner development of capital—the struggle to control labor, the drive to accumulation, the force of competition, the leverage of credit/finance, and the growth of the world market—there can, in the Marxian vision, be no simple theory of the global firm.43 A number of factors, however, can be singled out. Some of the first multinational firms were primarily organized around the search for raw materials, of which the oil and rubber companies are obvious examples. This continues to be an important factor in global corporate activities. A bigger factor, however, lies in the fact that capital in mature monopolistic (or oligopolistic) markets seeks carefully to regulate the expansion of output and investment in industries it controls in order to maintain higher prices and wider profit margins. Consequently, there is a constant search for new outlets for the potential economic surplus generated within production. Thus, the monopolistic corporation is “driven by an inner compulsion [i.e., by the accumulation process itself] to go outside of and beyond its historical field of operations. And the strength of this compulsion is the greater the more monopolistic the firm and the greater the amount of surplus value it disposes over and wishes to capitalize.”44

A corporation with surplus to invest and seeking profits in other industries and other countries has the choice of indirect portfolio investment (i.e., a mere monetary investment) or direct ownership and control of subsidiaries.45 To choose the latter course usually means that the corporation has certain monopolistic advantages vis-à-vis competitors that it believes it can exploit—for example, economies of scale in production, access to capital/finance on more favorable terms, technological (or research and development) advantages, patents, managerial assets, a more developed sales effort, etc.—all of which will allow it to erect barriers to entry, and obtain monopoly profits. A corporation may believe it is able to achieve increased strategic control over its worldwide operations, creating greater stability for the firm.46 Intrafirm trade between parents and affiliates of multinational corporations (and between various affiliates) often allows a corporation to elude taxes, by apportioning profits/losses between one unit and another in such a way as to take advantage of the differences in national laws.

The oligopolistic nature of multinational corporate expansion means that firms are constantly strategizing ways to outmaneuver their rivals. Thus, Graham and Krugman argue that FDI commonly takes the form of an “‘exchange of threat,’ in which firms invade each others’ home markets as part of an oligopolistic rivalry.”47

A crucial factor determining the operations of multinational corporations—already referred to above—is the phenomenon that some analysts—beginning with Hymer, and continuing more recently with Keith Cowling, Roger Sugden, and James Peoples—have called “divide and rule.”48 In the neoliberal age, corporations are able to roam the world, with most obstacles to “free trade” (that is, the free mobility of capital) removed, while labor, unable to move easily, is rooted in particular nations and localities due to immigration laws, language, custom, and numerous other factors.

What David Harvey has called “accumulation by dispossession,” associated with the mass global removal of peasants from the land by agribusiness and peasant migration to overcrowded cities, has greatly increased the industrial reserve army of labor worldwide. On top of this, the fall of the Soviet bloc and the integration of China into the capitalist world economy increased the number of workers competing with each other worldwide. All of this has led some corporate analysts to speak of the “great doubling” of the global capitalist workforce.49 This means that the global reserve army of labor has grown by leaps and bounds in the last couple of decades, making it easier to play increasingly desperate workers in different regions and nations off against each other.

A key element in this strategy of divide and rule, as noted, is the reliance by multinationals on subcontracting firms, which often utilize the most brutal forms of exploitation, outside of all forms of regulation, particularly in the global South. For example, the production of almost all of Apple’s iPhones and iPads is outsourced to the Taiwanese manufacturing firm Foxconn, which owns and operates factories in (mainland) China. In the first five months of 2010, sixteen workers jumped (with twelve dying) from the high buildings at Foxconn’s Longhua, Shenzhen factory, where over three hundred thousand to four hundred thousand employees eat, work, and sleep under horrendous conditions. Compelled to carry out the same rapid hand movements for long hours and for months on end, workers find themselves twitching all night. As a symbol of their plight, they have twisted Foxconn’s Chinese name so that it sounds like “Run to Your Death.”50

The threat to move production abroad to areas where wages are cheaper and working conditions are worse is directed at workers almost everywhere, even in the low-wage periphery of the world capitalist system, anytime workers try to organize. A classic case can be found in Britain in 1971, when Henry Ford II declared, in response to strikes by British auto workers, that parts of the Ford Escort and Cortina models would, in the future, be manufactured in Asia. Surveys of the management of multinational corporations in the United States have indicated that they are not averse to using such threats of shifting production abroad in disputes with unions (while surveys of unions suggest this even more strongly). The result of this strategy, euphemistically called flexible production, is to fragment and weaken labor organization globally.51 All of this is part of the control of the labor process that is inseparable from the division of labor and the system of exploitation under capitalism. Flexible production represents a new international division of labor, based on dispersed global production, which is often justified in technological terms, but has as its core the search for cheaper, more exploitable labor.52

As Keith Cowling wrote almost three decades ago in Monopoly Capitalism:

Capitalism has become increasingly nomadic, leaving a trail of social disruption in its wake. It will be privately efficient for each transnational corporation to adopt such a nomadic existence, reflecting as it does an appropriate response to rising labour costs and the opportunities offered by a more flexible technology, which in turn implies a reduced demand for broadly based skills in the workforce….Wherever workers act to raise wages or control the intensity or duration of work they will lose their jobs to other groups of less well organised and less militant workers in other countries. Thus de-industrialisation [in some industries of advanced capitalism] is a consequence of class struggle in such a world.53

This means that outsourcing production through foreign affiliates and subcontractors in the lower-wage sectors of the world economy is requisite in international oligopolistic rivalry. A “new nomadism” has emerged within production, with locational decisions determined largely by where labor is cheapest, and with imperial corporations pulling up stakes and moving elsewhere at the first signs of labor resistance.54

For today’s oligopolistic multinationals, global expansion is understood to be an imperative for accumulation, and hence survival. If one major corporation moves into a new market, its rivals have to follow quickly or risk being shut out. Some economic theorists such as Graham and Krugman call this the “‘follow the leader’ pattern” of multinational corporate investment.55

Trade itself is no longer to be seen realistically as resulting primarily from free market forces—as in neoliberal theory—but as more and more the product of the interactions between the parent companies of multinationals and their affiliates, and therefore increasingly taking the form of intrafirm trade. In the United States, trade is completely dominated by multinationals. As John Dunning and Sarianna Lundan observe in International Enterprises and the Global Economy (2008): “Combining the share of US MNE parents and that of foreign affiliates in the US, MNEs accounted for 77% of US exports and 65 percent of imports in 2002.”56 Hence, where U.S. international trade is concerned, it is fast approaching the situation where multinational corporations are the only actors.57 “Transnationalisation,” Cowling wrote in 2005, referring to the global growth of multinational or transnational corporations, “introduced an added dimension of control over the market—it brings control by giant firms to the pattern and dimensions of trade and therefore undermines the possible impact of trade in restraining monopoly or oligopoly pricing behaviour within national markets.”58

The Contradictions of International Monopoly Capital

The main consequences of the internationalization of monopoly capital for accumulation are the intensification of world exploitation and a deepening tendency to stagnation. Since the 1970s, there has been a worsening slowdown in the rate of growth of the world economy centered in the advanced capitalist economies—while many of the most dire effects of the world crisis are falling on the poorest countries of the world. The growth of international monopoly-finance capital has not only spread stagnation across much of the globe but has also given rise to financialization, as the giant firms, unable to find sufficient investment outlets for their enormous economic surpluses within production, increasingly turn to speculation within the global financial sphere.59 As a result, financial crises have become both more common and more severe, while state systems everywhere are increasingly subject to the whims of giant capital and are forced to bail out corporations that are deemed “too big to fail.” Governments at the national, regional, and local levels seek to clear up the resulting fiscal crises by hammering the general public, cutting back on social services while creating more regressive tax systems, thereby ratcheting up the effective level of exploitation in society. Hence, the internationalization of monopoly capital, rather than contributing to the stabilization of the world system, is generating ever-greater crises, not only for the private economy but also for state systems.

Inequality, in all its ugliness, is, if anything, deeper and more entrenched. Today the richest 2 percent of adult individuals own more than half of global wealth, with the richest 1 percent accounting for 40 percent of total global assets.60 If, in the “golden age” of monopoly capitalism in the 1960s, the gap in per capita income between the richest and poorest regions of the world fell from 15:1 to 13:1—by the end of the twentieth century, the gap had widened to 19:1.61 From 1970 to 2009, the per capita GDP of developing countries (excluding China) averaged a mere 6.3 percent of the per capita GDP of the G8 countries (the United States, Japan, Germany, France, the United Kingdom, Italy, Canada, and Russia). From 2000 to 2006 (just prior to the Great Financial Crisis), this was only slightly higher, at 6.6 percent. Meanwhile, the average GDP per capita of the forty-eight or so Least Developed Countries (a UN-designated subset of developing countries) as a share of average G8 GDP per capita declined from 1.8 percent in 1970, to 1.3 percent in 2006.62 The opening decade of the twenty-first century has seen waves of food crises, with hundreds of millions of people chronically food-deprived, in an era of rising food prices and widespread speculation.63

The supreme irony of the internationalization of monopoly capital is that this entire thrust toward monopolistic multinational-corporate development has been aided and abetted at every turn by neoliberal ideology, rooted in the “free market” economics of Hayek and Friedman. The rhetoric invariably promotes human freedom, economic growth, and individual happiness—or “democracy” in popular parlance—on a global scale, with no outposts of “tyranny” remaining. There are, in the Hayekian view, two enemies of this rosy future: labor and the state (insofar as the latter serves the interest of labor and the general population).64

This neoliberal campaign for the internationalization of monopoly capital is not merely an attack on the working class. Rather it must be understood, more broadly, as an attack on the potential for political democracy, that is, on the capacity of the people to organize as an independent force to counteract the power of corporations. With no clear notion they are contradicting themselves, much less denying reality, neoliberals paint a picture of a small “libertarian” state that gets out of the way of individuals, business, and free markets worldwide. Yet, to paraphrase the old calypso song, this millionaire’s “libertarian” heaven is the poor person’s hell.

In fact, state spending across the planet has hardly shrunk. Instead, states increasingly serve the needs of national and international monopoly capital, by aiding and abetting “the take” of their “own” giant corporations—with political elites corrupted by payoffs, which come in innumerable forms. At the same time, these quasi-privatized state systems have become ever more preoccupied with incarcerating and oppressing their domestic populations.65

Just as, nationally, any state programs that aid the working-class majority are targeted by neoliberalism, so, internationally, the primary goal is to remove—in the name of “free trade”—any limits on the power of multinational corporations exercised by nation-states. This mainly hurts the weaker states, where such rules are more stringently imposed by international organizations (principally the IMF, the World Bank, and the WTO) controlled by the rich countries—and where there is less capacity to resist the intrusion of global corporations. The very reality of economic stagnation in the neoliberal era has been used as a further justification for the freeing up of the market on behalf of the giant firms.

The domination in our time of global monopoly-finance capital means that every new crisis is a financial crisis, taking the form of a debt bubble that expands, only to burst in the end. Only those states large enough and strong enough to resist the full force of neoliberalism are able to prosper to some degree in these circumstances, though often the “prosperity” does not extend much beyond the plutocracies that rule them. Meanwhile, the so-called failed states that now dot the world are a manifestation of the crushing blows that international monopoly capital (backed up, when needed, by the military force of imperial nations) has inflicted on most of the world’s population.

Notes

- ↩ Paul M. Sweezy, “More (Or Less) on Globalization,” Monthly Review 49, no. 4 (September 1997): 3-4.

- ↩ Richard J. Barnet and Ronald E. Müller, Global Reach: The Power of the Multinational Corporations (New York: Simon and Schuster, 1974), 213-14.

- ↩ The notion of a dialectic of rivalry and collusion characterizing oligopolistic firms has been developed by Keith Cowling, based on the work of Baran and Sweezy in Monopoly Capital. See Keith Cowling, “Monopoly Capitalism and Stagnation,” 155-66 in Tracy Mott and Nina Shapiro, eds., Rethinking Capitalist Development: Essays on the Economics of Josef Steindl (New York: Routledge, 2005).

- ↩ UNCTAD, World Investment Report, 2010 (New York: United Nations, 2010), 17-18.

- ↩ Mark Casson, “Multinational Monopolies and International Cartels,” in Peter J. Buckley and Mark Casson, eds., The Economic Theory of the Multinational Enterprise (London: Macmillan, 1985), 65; V.I. Lenin, Imperialism, the Highest Stage of Capitalism (New York: International Publishers, 1939).

- ↩ Galambos quoted in G. Pascal Zachary, “Let’s Play Oligopoly! Why Giants Like Having Other Giants Around,” Wall Street Journal, March 8, 1999.

- ↩ “Let’s Play Oligopoly!” Wall Street Journal.

- ↩ For data and analysis of this see John Bellamy Foster, Robert W. McChesney, and R. Jamil Jonna, “Monopoly and Competition in the Twenty-First Century,” Monthly Review 62, no. 11 (April 2011): 10-11.

- ↩ For UNCTAD the primary source for MNC data, “foreign affiliate” is defined as ownership of least 10 percent of voting stock. This conforms also to the approach of the IMF. In the United States, however, the Bureau of Economic Analysis uses a threshold of 50 percent.

- ↩ In accord with UNCTAD data, U.S. totals are for nonbank U.S. parents and nonbank majority-owned Foreign Affiliates. See Chart 1 and Kevin B. Barefoot and Raymond J. Mataloni Jr., “U.S. Multinational Companies: Operations in the United States and Abroad in 2008,” Survey of Current Business 90, no. 8 (2010), Tables 16.2 and 18.2. The percentages for foreign affiliates are 12, 24.6, and 22.8 percent of assets, sales and employment respectively.

- ↩ Barefoot and Mataloni, “U.S. Multinational Companies,” 207.

- ↩ Joseph P. Quinlan, Global Engagement (Chicago: Contemporary Books, 2001), 37-41; UNCTAD, The Universe of the Largest Transnational Corporations (New York: United Nations, 2007), 3.

- ↩ Wladimir Andreff, “Outsourcing in the New Strategy of Multinational Companies: Foreign Investment, International Subcontracting and Production Relocation,” Papeles de Europa 18 (2009),19.

- ↩ Keith Cowling and Roger Sugden, Beyond Capitalism (London: Pinter Publishers, 1994), 35.

- ↩ Walter LaFeber, Michael Jordan and the New Global Capitalism (New York: W.W. Norton, 2002), 107, 126, 147-49; Richard J. Barnet and John Cavanagh, Global Dreams: Imperial Corporations and the New World Order (New York: Simon and Schuster, 1994), 326-27; Jeff Ballinger, “Nike Does It to Vietnam,” Multinational Monitor 18 no. 3 (March 1997).

- ↩ Anita Chan, “Nike and its Satanettes” (1999), http://business.nmsu.edu.

- ↩ “Nike’s New Game Plan for Sweatshops,” Bloomberg Business Week, September 20, 2004, http://businesweek.com. On the general issue of sweatshops in international textile and shoe production see Robert J.S. Ross, Slaves to Fashion: Poverty and Abuse in the New Sweatshops (Ann Arbor: University of Michigan Press, 2004).

- ↩ Mujeres Transformando and Institute for Global Labour and Human Rights, “Ocean Sky Sweatshop in El Salvador: Women Paid Just 8 Cents for Each $25 NFL Shirt They Sew” (Pittsburgh, PA: The National Labor Committee, January 24, 2011), http://www.globallabourrights.org. See also Bernard D’Mello, “Reebok and the Global Sweatshop,” Monthly Review 54, no. 9 (February 2003): 26-40.

- ↩ Beatrice Appay, “Economic Concentration and the Externalization of Labour,” Economic and Industrial Democracy 19, no. 1 (1998), 161; Yadong Luo, Multinational Enterprise in Emerging Markets (Copenhagen: Copenhagen Business Press, 2002), 199-200. See also Keith Cowling and Roger Sugden, Transnational Monopoly Capitalism (New York: St. Martin’s Press, 1987), 3, 88-90.

- ↩ Louis Galambos, “The Triumph of Oligopoly,” in Thomas Weiss and Donald Schaefer, ed., American Economic Development in Historical Perspective (Princeton: Princeton University Press, 1994), 252.

- ↩ World Motor Vehicle Production 2009, “OICA Correspondents Survey without double counts,” http://oica.net.

- ↩ See James K. Galbraith, The Predator State (New York: Free Press, 2008), 19-24.

- ↩ Milton Friedman, Capitalism and Freedom (Chicago: University of Chicago Press, 1962), 119-20.

- ↩ Foster, McChesney, and Jonna, “Monopoly and Competition in the Twenty-First Century,” 13-19.

- ↩ Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966), 57-59.

- ↩ Joseph A. Schumpeter, Capitalism, Socialism, and Democracy (New York: Harper and Brothers, 1942), 90.

- ↩ Edward M. Graham and Paul R. Krugman, Foreign Direct Investment in the United States (Washington, D.C.: Institute for International Economics, 1995), 193.

- ↩ John Bellamy Foster and Robert W. McChesney, “The Internet’s Unholy Marriage to Capitalism,” Monthly Review 62, no. 10 (March 2011): 1-30.

- ↩ Competition in economics is largely about competition between firms over product markets/sales markets. Competition between workers within labor markets lies largely outside of this conception. On the importance of this distinction see Cowling and Sugden, Transnational Monopoly Capitalism, 4.

- ↩ The role of “divide and rule” as a key strategy governing the actions of multinational corporations is discussed more fully under the section “The Law of Increasing Firm Size and the Rise of the Multinational Corporation” below.

- ↩ Pierre Bourdieu, Acts of Resistance: Against the Tyranny of the Market, (New York: The New Press, 1999), 98; Insull quoted in Arthur M. Schlesinger, Jr., The Crisis of the Old Order (New York: Houghton Mifflin, 1957), 120.

- ↩ Marx, Capital, vol. 1 (London: Penguin, 1976), 739.

- ↩ Stephen Herbert Hymer, The Multinational Corporation: A Radical Approach (New York: Cambridge University Press, 1979), 54.

- ↩ Stephen A. Marglin, “What Do Bosses Do?: The Origins and Functions of Hierarchy in Capitalist Production,” Review of Radical Political Economics 6, no. 2 (Summer 1974): 80-104; Cowling and Sugden, Transnational Monopoly Capitalism.

- ↩ As John Dunning has argued, Marx, and after him Rudolf Hilferding, were the first to develop the notion of internalization in explaining the growth of the firm; however, in their theories such internalization was not of transaction costs—as in the neoclassical Coasian theory of the firm—but of labor within a context of control and exploitation. See John H. Dunning, Explaining International Production (London: Unwin Hyman, 1988), 130-32.

- ↩ Karl Marx, Capital, vol. 1, part 4.

- ↩ Richard Edwards, Contested Terrain (New York: Basic Books, 1979), 44, 226-27.

- ↩ Illustrations of the role of the state in the growth of large capitals can be found in Kevin Phillips, Wealth and Democracy: A Political History of the American Rich (New York: Broadway Books, 2002).

- ↩ Alfred Marshall, Principles of Economics, vol. 1 (London: Macmillan, 1961), 317-18.

- ↩ See Edwards, Contested Terrain, 3-71.

- ↩ Marx, Capital, vol. 1, 1019-38. The role of scientific management and its relation to monopoly capitalism is examined in great detail in Harry Braverman, Labor and Monopoly Capital (New York: Monthly Review Press, 1998).

- ↩ Harry Magdoff, Imperialism: From the Colonial Stage to the Present (New York: Monthly Review Press, 1978), 166-67.

- ↩ The best mainstream approach to the rise of the multinationals, accordingly, is the “eclectic paradigm” developed by John Dunning, which emphasizes a large number of factors, including both monopolistic advantages (in line with Hymer) and the internalization of market costs. It, however, has the disadvantage of not putting accumulation at the center of the analysis. For a concise summary of the eclectic paradigm see Geoffrey Jones, Multinationals and Global Capitalism (New York: Oxford University Press, 2005), 12.

- ↩ Paul M. Sweezy and Harry Magdoff, The Dynamics of U.S. Capitalism (New York: Monthly Review Press, 1972), 99.

- ↩ For a classic expression of this see Robert Gilpin, U.S. Power and the Multinational Corporation: The Political Economy of Foreign Direct Investment (New York: Basic Books, 1975).

- ↩ The emphasis on strategic control as the defining trait of the modern giant corporation or multinational—a form of control that evolves out of capital’s domination of the labor process from the very beginning of the workshop/factory system—is in many ways the centerpiece of the work of Cowling and Sugden in their Transnational Monopoly Capitalism, 8-27. See also Graham and Krugman, Foreign Direct Investment in the United States, 36.

- ↩ Graham and Krugman, Foreign Direct Investment in the United States, 193.

- ↩ Hymer, The Multinational Corporation, 86-88; James Peoples and Roger Sugden, “Divide and Rule by Transnational Corporations,” in Christos N. Pitelis and Roger Sugden, eds., The Nature of the Transnational Firm (London: Routledge, 2000), 174-92.

- ↩ David Harvey, The New Imperialism (New York: Oxford University Press, 2003, 137-82; Richard B. Freeman, “The New Global Labor Market,” Focus (University of Wisconsin-Madison Institute for Research on Poverty) 26, no. 1 (Summer-Fall 2008): 1-6; Joseph P. Quinlan, The Last Economic Superpower (New York: McGraw Hill, 2011), 176.

- ↩ “Inside Foxconn’s Factory,” The Telegraph (UK), May 27, 2010, http://telegraph.co.uk.; “Foxconn Cuts Off Suicide Compensation,” The Australian, June 12, 2010, http://theaustralian.com.au.

- ↩ Peoples and Sugden, “Divide and Rule,” 182-89.

- ↩ On the unequal exchange process that this process relies on and reinforces, wherein wage differences are greater than the difference in productivity, see Gernot Köhler, “A Critique of the Global Wage System” (2006), http://caei.com.ar.

- ↩ Keith Cowling, Monopoly Capitalism (New York: John Wiley and Sons, 1982), 145.

- ↩ Keith Cowling, “Monopoly Capitalism and Stagnation,” 150.

- ↩ Graham and Krugman, Foreign Direct Investment in the United States, 193. As Sam Gibara, CEO of Goodyear Tire and Rubber Co., declared in 1999, “What you have is a chain reaction. We’re going global because our customers are going global. Then, to the extent that we go global, our suppliers are going global.” What Gibara refrained from mentioning was that Goodyear’s rivals were going global too—a development that Goodyear sought to address by creating strategic alliances, a form of collusion, with other firms (in 1999 it established a strategic alliance with Sumitomo Rubber Industries Ltd. of Japan). In “Let’s Play Oligopoly!” Wall Street Journal.

- ↩ John H. Dunning and Sarianna M. Lundan, Multinational Enterprises and the Global Economy (Northampton, Massachusetts: Edward Elgar, 2008), 487.

- ↩ See Cowling and Sugden, Beyond Capitalism, 67-69.

- ↩ Cowling, “Monopoly Capitalism and Stagnation,” 150.

- ↩ On the relation of international oligopoly to stagnation see Cowling and Sugden, Beyond Capitalism, 91-113. On monopoly capital and global financialization see John Bellamy Foster and Fred Magdoff, The Great Financial Crisis (New York: Monthly Review Press, 2009).

- ↩ James B. Davies, Susanna Sandström, Anthony Shorroks, and Edward N. Wolff, “The World Distribution of Household Wealth,” in James B. Davies, ed., Personal Wealth from a Global Perspective (Oxford: Oxford University Press, 2008), 402.

- ↩ Angus Maddison, The World Economy: A Millennial Perspective (Paris: Development Centre, OECD, 2001), 125-26.

- ↩UNCTADStat, “Nominal and real GDP, total and per capita, annual, 1970-2009: US Dollars at constant prices (2000) and constant exchange rates (2000) per capita,” (New York: UNCTAD), http://unctadstat.unctad.org. Today the Least Developed Countries, as designated by the UN, include thirty-three in Africa, fourteen in Asia and one in Latin America and the Caribbean.

- ↩ See Fred Magdoff and Brian Tokar, eds., Agriculture and Food in Crisis (New York: Monthly Review Press, 2010).

- ↩ In Daniel Yergin and Joseph Stanislaw’s neoliberal triumphalist tract (about how Hayek won over Keynes) the great enemy is the state while corporations are downplayed and “corporation” doesn’t even deserve an entry in the index. This is all the more startling since Yergin has spent most of his career in support of the giant oil corporations. See Daniel Yergin and Joseph Stanislaw, The Commanding Heights (New York: Simon and Schuster, 2002).

- ↩ Bernard E. Harcourt, The Illusion of Free Markets: Punishment and the Myth of Natural Order (Cambridge: Harvard University Press, 2011).

Comments are closed.